After rising 120% in November and entering the top ten in the ranking Cryptocurrency By market capitalization, Avalanche (AVAX) entered a correction phase, losing 10th place to Dogecoin (dog) Now everyone wants to know where the latest market trends are heading in the short and medium term. Since accessing Historical maximum From $146.22 on November 21, AVAX is already down 21.5%.

As of this writing, it was at $118.00, the lowest price of the day over 9%. Despite the sharp decline in the past 24 hours, in the past seven days, the avalanche still shows a positive variance of 10% from I woke up With CoinMarketCap data. Among the top 20 cryptocurrencies, only AVAX, Crypto.com Coin (CRO), and Polygon (MATIC) are not in the red at the moment.

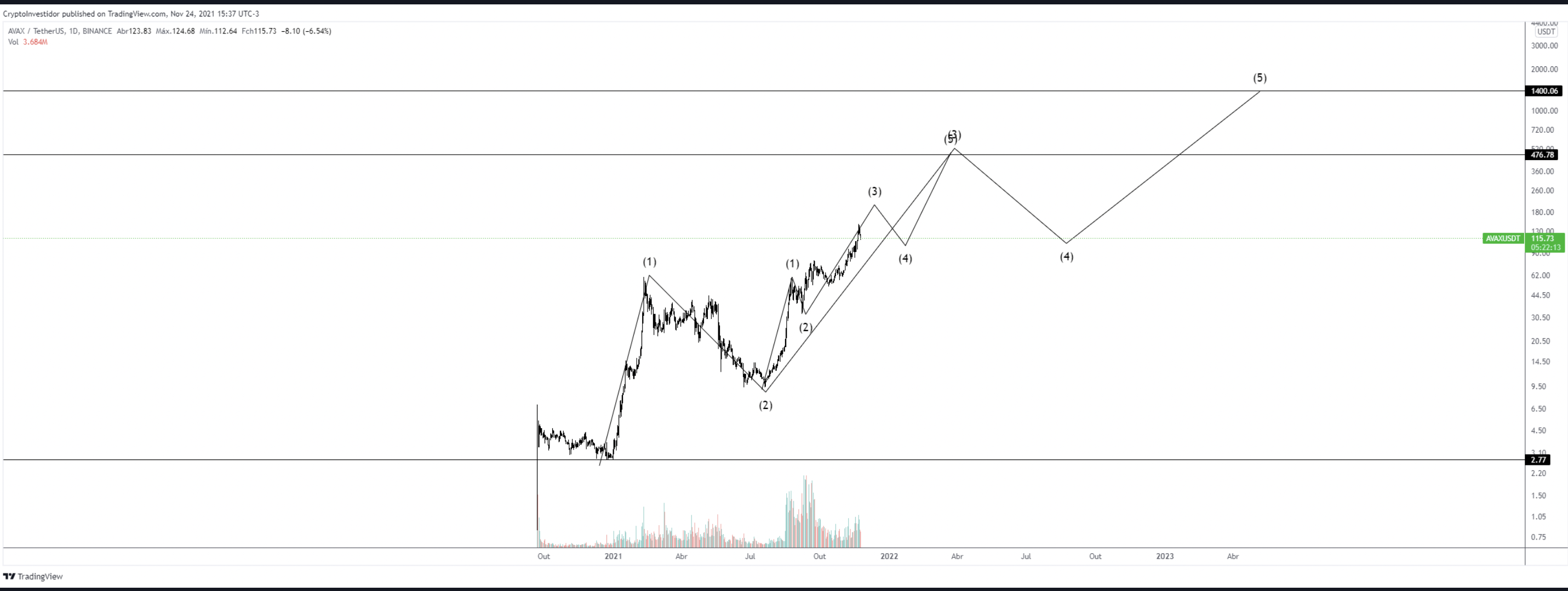

AVAX/USDT daily chart. Source: Trading View.

AVAX trading volume has remained relatively high throughout November, especially on days when the cryptocurrency closed higher, which is a clear indication of the euphoria of individual investors.

Although volume is slightly lower compared to the bullish rally in August and September, announcements from Partnership with Deloitte, a leader in auditing, advisory, financial advisory and risk assessment services, and a new program to attract developers into its ecosystem has consistently supported the emergence of AVAX.

Davey ecosystem

Despite the general correction of the market in recent days and AVAX specifically since Tuesday, the total closed value (TVL) in the avalanche network has not declined. On the contrary, it has continued to rise. Even milder in the last 24 hours – only 0.39%.

However, in this week’s cumulative result, the network’s TVL grew nearly 20%, representing $2 billion in inputs, and today it’s $12.47 billion, from I woke up With Defi Llama data monitoring platform.

In the same period, the avalanche has surpassed Terra (LUNA) and is now only behind the leader Ethereum (ETH), da Smart Binance Series and yes Solana (SOL) in terms of TVL, providing evidence that the ecosystem DeFi of the protocol under full development.

Notably, DEXs (Decentralized Exchanges) and asset valuations based on the avalanche blockchain contributed to this huge increase in TVL at a time when the market was experiencing massive losses.

sun repeat

Traders and analysts have compared AVAX’s recent price action to the Solana (SOL) track in August and September. And there are indeed similarities, such as the fact that both the bulls, then and now, occurred independently, completely unrelated to the general sentiment of the market.

Cointelegraph Brazil consulted Diego Consimo, founder of Crypto Investidor, to see if AVAX is just undergoing a natural correction after renewing historical highs and can still match Solana’s performance throughout 2021.

Consimo told the article that AVAX should remain in an already uptrend:

“The avalanche is in a nice bullish move aiming for the $450.00 to $600.00 range. This represents a 300% to 450% increase potential with respect to the current exchange rate of $118.00 in the US. In the current cycle, it has It has already risen about 5,000% since January, if it hits said target, it will build up 17,000% to 22,000% higher in the current market cycle.

No one can accurately predict when the current cycle will end, which will lead to another crypto winter. But Consimo and other analysts believe the summit should come sometime during the first half of 2022.

Predict AVAX price action through 2023. Source: Crypto Investidor.

Looking at the long-term, an analyst at Crypto Investidor sees the odds that the AVAX/USDT pair will cross $1,000 sometime between 2023 and 2025.

In contrast, so far in 2021, SOL has already amassed more gains than AVAX can achieve, according to Consimo forecasts:

Solana has already delivered a 24,000% increase in 2021 and should continue to rise a little more, as it seeks the range around $350.00 to $450.00. If Solana can reach these value levels, it will have a cumulative increase of about 30,000% by the end of 2021.

Consimo stresses that the institutional and financial support that Sam Bankman-Friedman provided to Solana has been critical to SOL’s impressive performance throughout 2021 and that hardly any other asset will be able to naturally replicate it.

Short-term

Meanwhile, in the short term, the Cointelegraph analyst Rakesh Upadhyay It indicates that the current AVAX retracement may find support in the area between the 38.2% Fib retracement level at $112.63 and the 20-day exponential moving average ($103).

Also, according to the analyst, if the price bounces outside this area, it means that traders are buying the lows and the sentiment remains positive, with the possibility of a retest of the historic high soon.

Read more

Direct your links to OKEx in articles, blogs and videos, or place an ad on your website. The best affiliate program is on OKEx with 60% commission, which is the highest in the market.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”