Total home purchase loans increased by 4.8% in April, to 98.3 billion euros, compared to the same period in 2021. The Bank of Portugal (BdP) revealed that this growth is similar to what it recorded in March. After all, financial institutions only gave 3.3 million euros per day in real estate acquisitions, and at the moment do not reflect the restrictions imposed by the regulator.

The Bank of Portugal, as of April, imposed new limits on the maximum maturity of new mortgage loans according to age.

For customers over 35 years of age, the credit maturity date must not exceed 35 years. For bank customers over 30 years old and less than or equal to 35 years old, the maximum credit term should be 37 years. Loans of up to 40 years are now possible for those less than or equal to 30 years of age.

However, analysts contacted by Sunrise admitted that this effect is not yet visible. Lending for housing remains at high levels but the recent restrictions are not expected to have a significant impact on this trend. On the other hand, these new measures can get young people to use home loans earlier”, says Henrique Tomé, of XTB.

Nuno Garcia, General Manager of GesConsult, acknowledges that we have been noticing a “credit rush” since the restrictions were announced, and thus the maximum loan amounts have been reached in March since 2007. In the future, he believes “these restrictions may have an impact on home purchases.” , as the conditions will gradually become shorter,” adding that “the situation deserves attention, especially when we notice that the terms of buying a house meet later.”

Alarms ringing

The alarm sounded not only for those who now got a house, but also for those who took out a loan to buy a house. The explanation is simple: in recent months, the European Central Bank has been brandishing a rate hike, moving away from the current negative interest rate scenario that hurts savings, but this greatly benefits those who pay to buy a home for the bank.

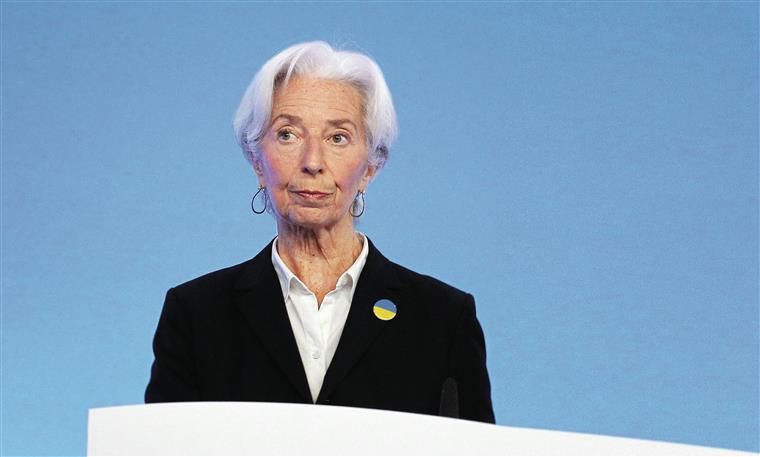

Already this week, Christine Lagarde acknowledged that just a “gradual” approach to the pace of rate hikes may not be enough to address inflation risks.

The central bank’s idea is to end debt purchases in the third quarter, and allow interest rates to rise for the first time in July, and the current ECB’s expectation is that by the end of the third quarter, interest rates in the eurozone will not be negative. – An indication of the interest rate on deposits, which is -0.5%.

Henrique Tomé says that the problem with the real estate market in Portugal was mainly related to the fact that there was so little supply for this huge demand for real estate. But he recognizes that “in the short term, an increase in interest rates could effectively reduce demand in the real estate market, which could translate into a slight price correction,” adding that “concerns about a possible economic slowdown could also fuel this scenario. Real estate price correction.

However, the XTB analyst is bullish and recalls that interest rates have been at their bottom line for several years, believing that despite starting to increase, these increases will be gradual and should not have a significant impact on families. “In fact, compared to what is happening in the United States, the European Central Bank is taking a more cautious stance, but in fact there is such a possibility. We have seen a slowdown in several sectors except for the real estate sector, which is still strong ».

But he points to the risks, noting that there are factors that have begun to appear that may contribute to a slowdown in this sector, such as high interest rates and medium and long-term risks that indicate a possible slowdown in economic growth.

The most pessimistic is Nuno Garcia, whose higher interest rates have raised monthly housing-related expenses, which include paying off the monthly loan. “For families, this is hard to get past, because paying the electricity, water and gas bills has often been really a challenge, with higher monthly credit payments the situation is getting worse.”

Under this scenario, the official advises buyers to analyze the situation well and understand whether they will be able to ensure payment of their expenses, “so as not to go through what happened in 2011, when the credits were stopped due to repayment. “.

Despite these risks, GesConsult’s general manager believes it will now be smaller than those seen at the time of the troika. He explains why: “We’re seeing more rules today in approving home credit and people are becoming more informed about the whole process. I don’t think we will go through the same situation. However, you have to be more careful, no doubt. We come out of one crisis and immediately enter another. The ability to adapt and consider is necessary, so that we do not go through the same thing again.”

spot solutions

If, on the one hand, Nuno Garcia says that the rental market can be seen as an opportunity and as an immediate solution to the market, Henrique Tomé advises those who are preparing to buy a home in the coming months to negotiate good prices in order to avoid paying an excessive amount for an overpriced and speculative property.

For i newspaper, Natália Nunes, who is in charge of Deco’s financial protection office, has already acknowledged that the decision to raise interest rates will inevitably affect those with mortgages and that it could acquire new features for consumers who are on the line with their mortgage payments. your expenses.

In alliance with that, we must now count on rising fuel, energy, food and transportation prices, among other things, and rising inflation. “This is a concern we have had since the beginning of the year. Consumers have been alerted to the need to accommodate their family budgets in case they face a change in interest rates, as this may have some impact on the premium to be paid to the bank at the end of the month.”

A greater headache for those who, according to the person in charge, already have a high rate of exertion. “It’s not just about the interest rate issue, it’s really all we feel every day is the rate hike, which has been happening since the beginning of the year. Most families reach the end of the month and end up spending a lot more than they used to, and their income doesn’t keep pace with the increase in these expenses,” says Natalia Nunes.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”