Since the beginning of the COVID 19 pandemic, the smartphone market has experienced very strong fluctuations. The greatest impact is on the most exposed brands, but it also affects consumers and the entire chain linked to their production.

A recent analysis showed that at the end of 2022 there are still brands that are slowing down in sales and mainly in their profits. Data from the third quarter of 2022 shows that even with a 10% price increase, global sales revenue fell 3%.

High smartphone prices and low sales

The recovery of the smartphone market and especially its sales has not been simple. At first they slowed down for reasons that everyone knows, but then followed a period when the entire production chain was affected very dramatically.

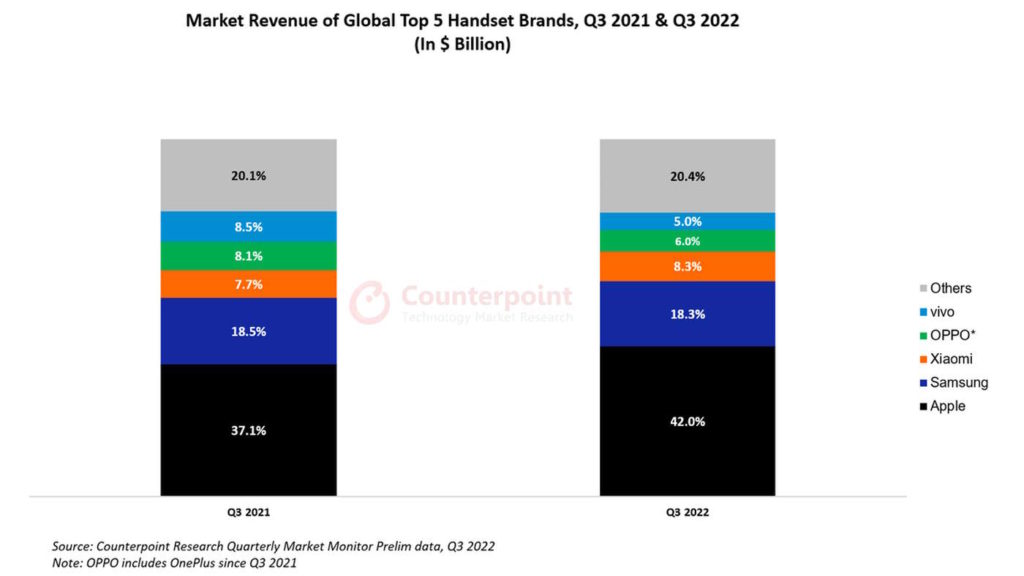

Now, in the third quarter of 2022, the data continues to show great fragility and it seems that only Xiaomi and Apple can grow in sales and prices. The numbers are clear Counterpoint Information Details of this scenario.

Firstly, it shows that the global smartphone market revenue decreased by 3% compared to the same period in the previous year, now reaching $100 billion. The average selling price (ASP) grew 10% year over year, due to the premium segment's increased security in the face of economic uncertainty.

Apple and Xiaomi are fighting back against this negative scenario

Apple saw annual revenue growth of 10% and average selling price growth of 7% in the third quarter of 2022. This is partly due to the launch of the iPhone 14, as well as the Pro models, especially the previous generation which continues to sell well.

Xiaomi's revenue grew 4% year-over-year, thanks in part to the mid-range and lower-end models. The share of sales in the price region above $300 decreased by about 1.5%. However, there has been a significant change in some price ranges, which has seen the brand's average selling price grow by 14%, and now stands at $205.

While Samsung remained the most profitable in the market, it saw a 4% year-over-year decline, even though it raised its average price by 2%. OPPO (and OnePlus), had a split-point scenario - average price and revenue - up 5% and 27% over the previous year, respectively.

“Coffee trailblazer. Social media ninja. Unapologetic web guru. Friendly music fan. Alcohol fanatic.”