China’s ban on bitcoin has been one of the most important news in recent months and one of the most important moments in the cryptocurrency market. For many, this ban was precisely the reason for the recent decline in Bitcoin and the difficulty of recovering the price in recent months. but stop Mike McGlone, strategic BloombergHowever, the Bitcoin ban in China could bring problems to the domestic economy of the Asian country.

McClone is a huge supporter of Bitcoin and believes that the price of the digital asset will rise this year, having previously claimed that the coin will still reach $100,000. In a recent tweet he talked about the current situation and believes so China’s Rejection of Cryptocurrency May Halt Economic Growth

On his official Twitter account, the Bloomberg strategist said that by rejecting open source crypto assets, the country’s economic growth could stabilize and stagnate for years to come.

“Hey China, good luck with this — bitcoin and dollar dominance.

We believe that China’s rejection of open source crypto activities can stabilize the country’s economic rise, while raising the value of the dollar and bitcoin.”

Hey #China? Good luck with that one – # bitcoinAnd #dollar dominance:

China’s rejection of open source crypto-assets may represent a stabilizing point in the country’s economic rise, we believe, with the glorification of the value of the US dollar and Bitcoin. pic.twitter.com/gI3rNjC9X7– Mike McGlone (@mikemcglone11) July 23, 2021

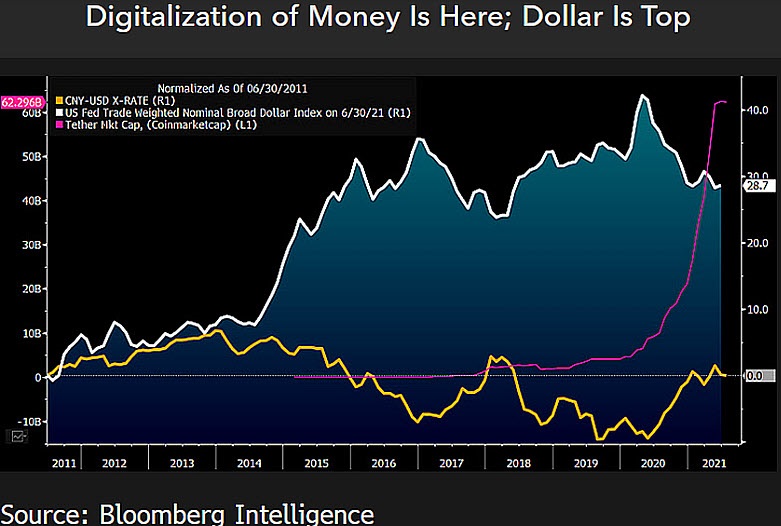

In his analysis, McClone highlighted not only Bitcoin, but also USDT (Tether) and other dollar-denominated cryptocurrencies. Even with no ‘digital dollar’ dollar project, USDT is ahead of Digital Yuan in terms of digitization

Thus, by banning and rejecting cryptocurrencies, China is losing a powerful form of digitalization and the yuan is staying far behind the dollar in this regard. This could hinder the currency’s future growth and even weaken the digital yuan’s plans to threaten the dominance of the dollar

Moreover, mining has been a powerful source of income in different regions of China, moving the local economy in different ways. The reduction of this economic flow is sure to bring more difficulties in the future of the Asian country.

This isn’t the first time McGlone has talked about Bitcoin’s connection to the Chinese ban, as he always says the country loses the most in this situation.

“Bitcoin and the digitization of money and finance could be a sign of China’s collapse. Hostile opposition from China may drive Bitcoin fundamentals in the long run.”

# bitcoin The digitization of money and finance has mark #China Autumn – Bitcoin headwinds from an increasingly hostile China could bolster the long-term fundamentals of the emerging reserve asset. pic.twitter.com/YjwCLXDOXS

– Mike McGlone (@mikemcglone11) June 28, 2021

With this said, it is necessary to wait for who will really win in the war of digitization of money, the United States, China or Bitcoin and its decentralized and free nature.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”