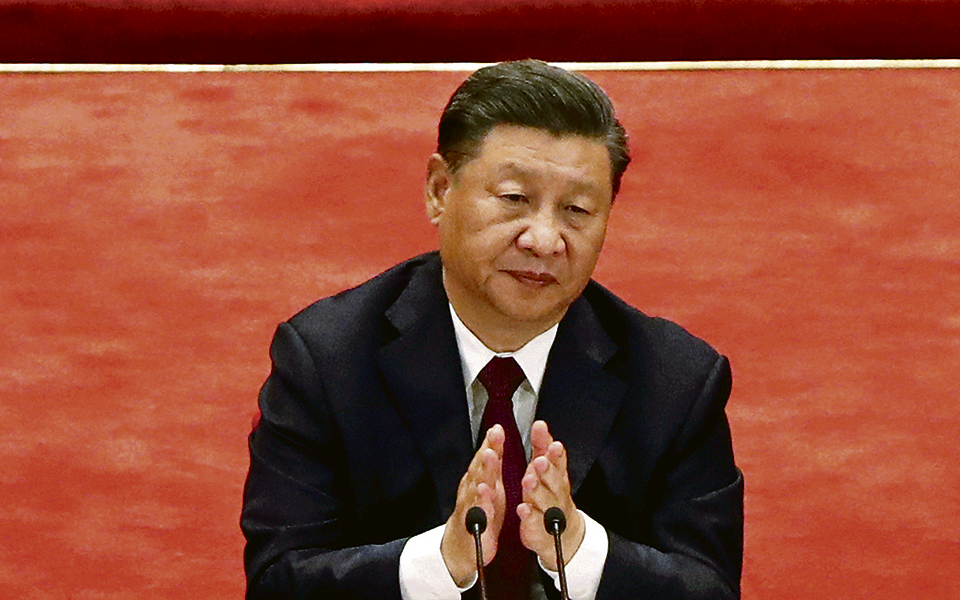

The Chinese Communist Party is concerned about the recorded declines and wants to build confidence in the country's stock market.

The Chinese government is evaluating the possibility of injecting US$278 billion to stabilize the country's stock market. The goal is to restore investor confidence in the Chinese stock market.

The plan is to withdraw funds from the foreign accounts of Chinese state-owned companies to buy shares through the Hong Kong Stock Exchange, Bloomberg revealed today.

The Chinese market, including Hong Kong, has already lost more than $6 billion since its peak in 2021. This year alone, foreign funds have sold $1.6 billion in Chinese stocks.

The CSI 300 index hit a five-year low this week, as Chinese authorities try to stem the sell-off seen in recent days, with small investors selling stocks to try to obtain liquidity at a time of financial tightening due to market problems. .

“The rescue package may not be enough to lift the market, but it will certainly dispel the idea that the government doesn't care,” said Fei-Cern Ling of Union Bancaire Privee.

“The package is welcome and shows that the authorities are concerned. But at less than 2% of GDP, we consider it insufficient,” commented Aninda Mitra of BNY Mellon Investment Management, quoted by Reuters.

Coincidence or not, in Portugal, Fosun, a private Chinese company, sold a 5% stake in BCP Bank, surprising investors. BCP was already down more than 7% today on the Lisbon Stock Exchange. Fosun sold a stake of about 6% for $235 million, and now owns 20% of Banque Centrale Populaire's capital (just over a year ago it owned nearly 30%).

In addition to Fosun's own company, Chinese state-owned enterprises have relevant stakes in several national listed companies, including EDP (China Three Gorges, 21%), REN (China State Grid, 25%) or Mota-Engil (China Communications Construction with 25%). 32%).

The idea of establishing this fund has been studied since October, but there is doubt about its success, because previous rescue operations were not always successful.

The real estate crisis, lack of consumer confidence, decline in foreign investment, and loss of confidence among businessmen after years of intense state management of the country are now having their negative effects on the economy and the market.

Bloomberg reveals that the authorities are analyzing other options and could announce them this week if they are approved.

At a State Council meeting on Monday, Premier Li Qiang and his government were briefed on the situation in the markets.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”