The world of crypto assets is not at all favorable. In fact, billionaire Microsoft founder Bill Gates stated this Wednesday that the value of cryptocurrencies and NFTs are “100% based on the bigger idiot theory.” To reinforce this idea, the market took another blow with the collapse of one of the largest cryptocurrency exchanges, FTX.

With an eight billion euro gap to be filled, FTX.com CEO Sam Bankman-Fried took to Twitter to apologize to customers and investors for the loophole that has left the cryptocurrency market in free fall and wiped out more than 200,000 million dollars worth of digital assets. .

Cryptocurrencies are based on “100% bigger goof theory”

The cryptocurrency market is going through a crisis and the lack of confidence is leading many investors to increase the level of caution. Added to these "risk signs" are statements such as that of Bill Gates, who the Microsoft founder said at a conference organized by the TechCrunch website "This type of [cripto] 100% assets based on biggest fool theorythat someone would pay more for it than me who "adds to it" and has a secrecy attached to it, evading taxes, government rules...I'm not involved in any of that."

Signs of concern increased after one of the largest cryptocurrency exchanges, FTX, after it went into a liquidity crisis, which prompted it to seek help from its rival Binance🇧🇷 Initially, this platform admitted to buying FTX, but ended up pulling out. The scenario exacerbated the crisis in this segment.

"I'm sorry. That's the biggest thing. Things got lost, and I should have done better." 🇧🇷 said Sam Bankman-Fried, CEO of FTX

FTX collapses and shakes the cryptocurrency world

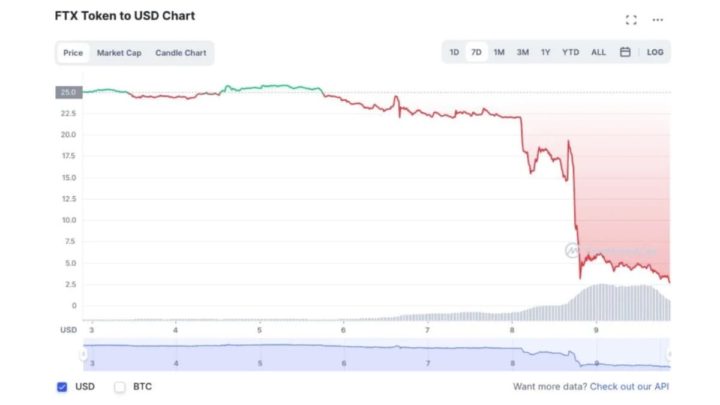

In the past few hours, cryptocurrency investors have once again seen strong signs of high volatility in the cryptocurrency market. a Many digital currencies, including Bitcoin, have dropped in value dramatically In recent days due to customers fleeing from FTX, one of the largest exchanges in the world to buy, sell and store these coins.

As echoed around the world, earlier this week, the Bahamas firm asked its rival Binance for help, after it received a surge in people withdrawing funds from the exchange causing a liquidity crisis. At first the contestant agreed to the proposal, but this Wednesday he changed his mind.

This afternoon, FTX asked for our help. There is a major liquidity crunch. To protect users, we have signed a non-binding letter of intent, with a view to obtaining it in full https://t.co/BGtFlCmLXB And help cover the liquidity crisis. We will be doing a full DD in the coming days.

- CZ 🔶 Binance (cz_binance) November 8, 2022

According to information from the Wall Street Journal, which cites a statement from Binance, CZ says:

Our hope was to be able to support FTX clients to ensure liquidity for them, but the issues are beyond our control and beyond our ability to help.

CoinDesk, a source at Binance, clarifies that it backed out of the deal due to news that FTX may have used customer funds incorrectly and because of Investigations by US regulatory agencies🇧🇷

As a result of corporate due diligence, as well as the latest news reports regarding mishandled client funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f🇧🇷

- Binance (binance) November 9, 2022

As can be read on Twitter, as a result of due diligence, as well as the latest news regarding misplaced customer funds and alleged investigations by US agencies, Binance has decided that it will not embark on a possible acquisition of http://FTX.com🇧🇷

Another Cryptocurrency Blow

With this scenario, the market shook again and Led Bitcoin to its lowest level in two years🇧🇷 The value was about 16 thousand dollars. The FTX coin - FTT - lost half its value on Wednesday.

It is a fact that cryptocurrencies have been on the decline for quite some time now. However, the problems with FTX were more wasting points.

The case includes some situations that may still be clarified. The collapse of crypto exchange FTX has prompted US authorities to investigate the company for possible violations of securities regulations, and analysts expect more problems in this market.

In the wake of the crash, FTX.com CEO Sam Bankman-Fred took to Twitter to apologize to customers and investors for an estimated $8 billion shortfall.

Sorry. This is the main thing. F# did with all of this and should have done better.

Happy Sam Bankman-Fried.

1) I'm sorry. This is the most important thing.

I had sex, and I should have been better.

- SBF (SBF_FTX) November 10, 2022

The CEO is ensuring that the funds are safe and that he is trying to resolve the situation, but sources contacted by the British Financial Times have indicated that FTX needs $8 billion (€7.8 billion at the current exchange rate) to solve the liquidity crunch.

These problems took investors by surprise. This is because of who At the beginning of 2022, the stock market was valued at $32 billionAfter raising $400 million in a funding round, Japanese technology giant Softbank was among the investors.

It is said that Bankman-Fried often met with US lawmakers to talk about the future of cryptocurrency; At the tech summits, the CEO shared the stage with politicians like Bill Clinton and Tony Blair.

However, the first warning signs began appearing last week. All this happened when a news article was published in an online magazine about cryptocurrencies, and CoinDeskHe cautioned that the balance sheet of Alameda Research, a sister service to FTX, is primarily made up of the FTT cryptocurrency. It is the official currency of FTX and gives its holders a discount when they use the platform. This means that FTX's exchange service, Alameda, relied on a coin invented by its sister company.

This has shaken confidence and prompted many Alameda and FTX users to withdraw their funds from the platforms. Over time, the out-of-services movement proliferated, leading to a liquidity crunch.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”