price Bitcoin (BTC) It fell below $30,000 and once again lit the alert for a new bear market. Although some enthusiasts claim that the so-called “alcohol marketNot yet, data analytics firm Glassnode has listed four reasons why BTC may not rise again anytime soon.

In its weekly report, Glassnode assessed the bearish outlook for bitcoin. Moreover, he revealed the reasons that might lead to a more pessimistic scenario regarding cryptocurrency.

Among them: a loss of interest from institutional investors, a drop in activity in the Bitcoin network, and price ranges with weak support according to their size.

institutional escape

As pointed out by Glassnode, the expiration of contracts worth tens of thousands of bitcoins in Grayscale’s investment fund is a potential catalyst for a significant price movement.

If the release of BTC in the market is confused with a decrease in the interest of institutional investors, this move appears to be pointing to the downside.

The report also indicated that 2 million bitcoins They were last moved between $31,000 – $34,000. IThis equates to 10.5% of the total BTC outstanding, Glassnode notes.

In the opinion of researchers, this price range represents a support node for the cryptocurrency. However, although it seems like a good support for Bitcoin, the analysis points in another direction:

“The market is trading at the lower end of this support node and there are few support levels below these prices.”

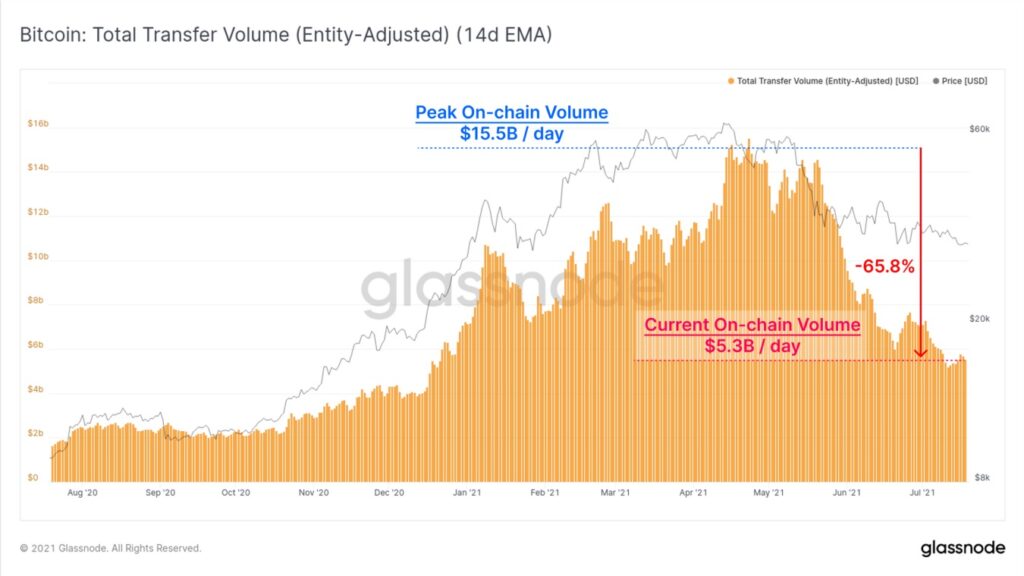

Bitcoin network activity is low

The third sign of an emerging bear market was found in low activity on the Bitcoin blockchain. Currently, about $5.3 billion is paid out daily. This represents a decrease of more than 65% from the peak in the second quarter of this year.

“This indicates that there is a relatively low demand for value adjustment,” the company said.

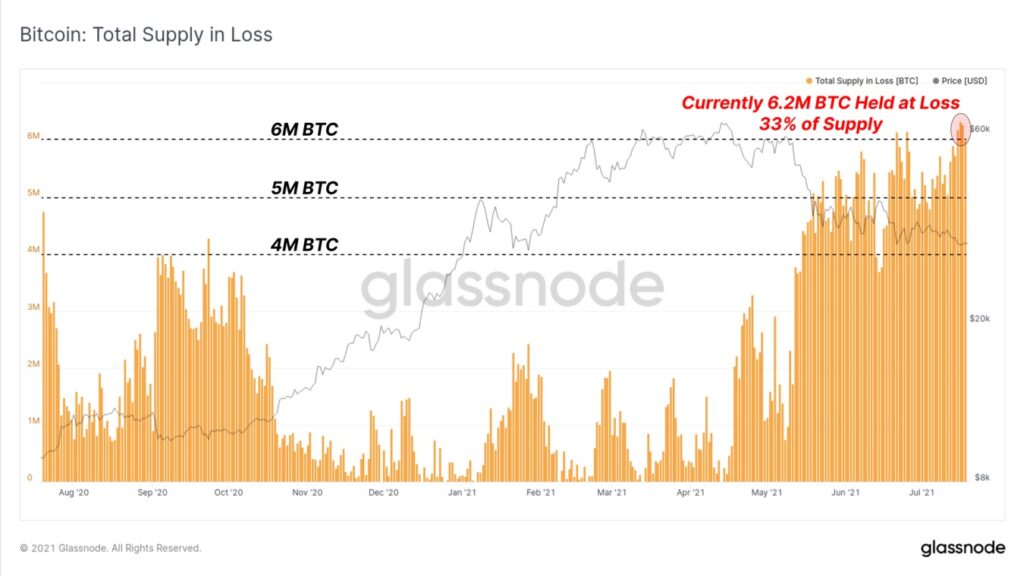

The report further specifies that the large amount of immovable BTC represents “unrealized losses.” That is, they are not real losses as long as they are not sold at current prices.

Read also: Bitcoin wipes out 2021 profits: Famous price prediction invalidated?

Read also: Bitcoin whales since 2018 stopped accumulating

Read also: Exchange FTX raised R$4.5 billion in investment rounds

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”