Green receipts are documents that a self-employed worker must produce to prove that he or she is paid for doing work. Did you know that the VAT exemption limit is now €14,500?

Green Receipts: Changes to the special exemption regime for Article 53 (Value Added Tax)

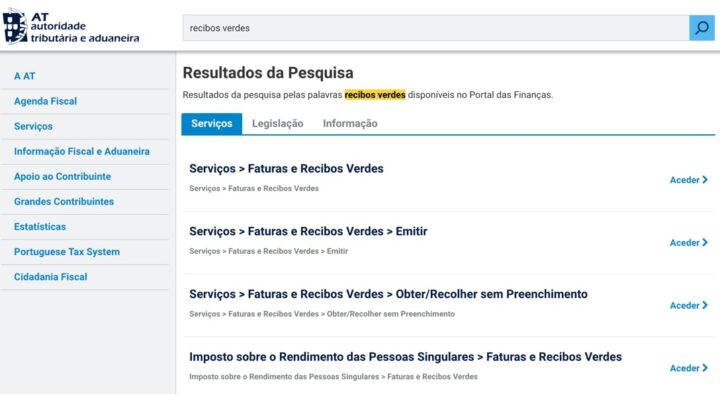

Have you received a job offer and been told you have to start billing? Fear not, because the whole process is simple and it's digital too. To get started, you just have to start the activity and then know how to fill out the invoice/receipt in question, those green receipts.

“Green vouchers” are typically associated with the self-employed. They are professionals who work independently, without a formal hierarchy or employment contract.

According to the Tax Agency, in 2024, the threshold value for applying the special exemption regime provided for in Article 53 is €14,500.

Therefore, only taxpayers who:

- In the previous calendar year (2023), they achieved sales equal to or less than €14,500;

- After the activity commenced in 2023, the turnover achieved, converted to a comparable annual turnover, was less than or equal to EUR 14,500;

- Starting activity in 2024, the expected turnover, converted to a similar annual turnover, is less than or equal to EUR 14,500.

In 2025 the value will rise to 15,000 euros.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”