Cryptocurrencies are gaining increasing global recognition. Not everything, of course, but it could be gaining more ground as an alternative to the traditional financial system. Easy access, speed of transactions and low costs are its features. But these benefits are not without significant challenges.

The decentralized nature of cryptocurrencies and lack of regulation and transparency can expose security vulnerabilities, such as fraud, theft, and cyberattacks. Currently, cryptocurrencies constitute, primarily, a form of speculative investment.

The extreme volatility that characterizes the market proves to be too risky, especially for less experienced investors. For this reason, PROTESTE INVESTE does not recommend that most investors invest large amounts in these assets. If you still want to enter the world of cryptocurrencies, choosing the right platform is crucial.

Investing in cryptocurrencies: potential problems

Platforms that allow cryptocurrency transactions are not safe from hackers. Increasingly frequent phishing attacks can lead to the inadvertent sharing of sensitive information, putting account security at risk.

However, the platforms’ problems are not limited to the usurpation of money or personal data. Any technical complications may lead to its malfunction, preventing users from accessing their accounts or conducting transactions in the required time.

The lack of proper regulation can also result in less legal protection for users in the event of disputes or problems with the platform. To mitigate these risks, it is essential to choose reputable platforms and adopt cybersecurity measures such as two-factor authentication. Keeping private keys in secure locations should be a top priority.

Another risk to consider is platform collapse. There is always the possibility of facing financial difficulties. In the event of bankruptcy, in the case of registered platforms, users can, under normal circumstances, exchange their crypto assets for fiat currency or transfer them to another platform. Investors’ rights are protected, as the assets they receive belong to them, not the assets of the platform they use.

However, a situation similar to that of FTX may occur, whose founder, Sam Bankman Fried, was arrested on charges of diverting client funds for his own benefit, resulting in a complete or partial loss for investors.

Finally, learning about threats and developments in the cryptocurrency space is crucial to making informed decisions.

Bitcoin and Ether lead the market

First of all, it is necessary to decide what we are going to compare. While it is true that we do not recommend investing in cryptocurrencies in general, this warning is more pronounced in the case of smaller cryptocurrencies.

Therefore, if you are determined to enter this world, you should, at least initially, focus on virtual currencies with a higher market capitalization. Their track record reveals that they are less volatile compared to others.

Bitcoin (BTC) and Ethereum (ETH) are the leaders. Together the two represent 60% to 70% of the total market. This well-established position leads us to believe that they would be the “safest” bet in such an unstable market. As such, we created a €500 basket made up of Bitcoin and Ether in equal parts (€250 each).

Likewise, we focus on the most popular platforms on the market, which allow users to buy cryptocurrencies directly. They are Binance, Coinbase, Kraken, Revolut, and Mercado Bitcoin. PROTESTE INVESTE considered including XTB and Degiro in the study, two platforms that offer a wide range of investment products. We have already analyzed it and even advised it in other contexts (investing in stocks and ETFs).

Degiro is registered with the Bank of Portugal as an EU credit institution, under freedom of provision, and XTB is registered with the CMVM as a financial intermediary. However, on these platforms, you can only invest indirectly in cryptocurrencies. In XTB, through a CFD (contract for difference), and in Degiro through ETN (exchange-traded notes, which are derivatives that are traded as if they were an ETF, where the financial institution undertakes to pay the borrower in exchange for the underlying asset).

Now, in general, we do not recommend investing through CFDs. Not only because of the potential costs of overnight financing fees (swap fees), which can erode investment returns if you keep a position open for too long, but also because of leverage. In addition to representing an increased cost, it is dangerous, especially for less experienced investors.

As for Degiro, this platform offers several ETNs that track the prices of different cryptocurrencies, one of which is called WisdomTree Crypto Mega Cap Equal Weight, and consists of 52% Bitcoin and 48% Ether. The allocation is very close to the basket we used as the basis for this analysis. Subscription and maintenance costs are reasonable, and unlike CFDs, ETFs and ETFs are recommended vehicles for long-term investment (depending on their composition). However, as mentioned, it is an indirect way to invest.

Furthermore, in Portugal, there is a tax issue to take into consideration. If you buy cryptocurrencies directly and do not sell them for 365 days, you will be exempt from taxes. Investing through other products (ETN or CFD) is always subject to 28 percent. In other words, from a tax perspective, these assets are subject to an unfavorable tax discrimination compared to direct investment in crypto assets, making them even more inadvisable. Therefore, economic rationality dictates that they are not the most appropriate options.

What are the safest platforms?

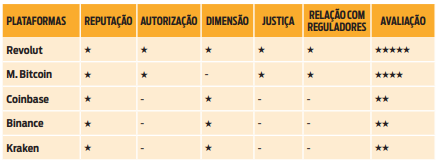

In order to compare the five investment platforms already mentioned, equal weight was given to each analysis criterion. In addition to costs, security was taken into account when evaluating it according to various criteria, including reputation, i.e. how each platform is perceived by the market and whether it has a good relationship with customers, and size – as the likelihood of problems occurring with a small business tends to It is higher than that of a large company.

As expected, we confirmed that regulators have authorized the sale of these products in Portugal, and whether the platforms have indeed been hit with fines or lawsuits. Finally, in the event of a dispute, whether it is possible to appeal to national entities or courts.

Binance, Coinbase, and Kraken top the global rankings for transaction volume and have good reputations. They allow direct access to cryptocurrencies and provide a high level of security. However, none of them have explicit permission to sell cryptocurrencies in Portugal.

Binance submitted a license application to Banco de Portugal in April 2022, which has yet to receive a response. It is also true that these cryptocurrency exchanges have been operating in our country for a long time under the guise of a legal vacuum, and there is no record of an abnormal number of complaints from users.

As a global fintech company, Revolut offers banking and investment services, including the direct purchase of cryptocurrencies. The company, which offers different subscription levels, each at different costs, also has a good reputation for security.

Mercado Bitcoin is a Portuguese system and allows the direct purchase of Bitcoin and Ether. It is licensed by Banco de Portugal to provide exchange services between virtual assets and fiat currencies. This mandate gives him enormous credibility and ensures some monitoring. However, in the world of crypto assets, there are very little to no guarantees, and it is a young and small company. It also has a relatively high margin, which affects transaction costs.

With the entry into force of the European Cryptoassets (MiCA) regulation, which will be implemented from December 30, 2024, new options will emerge to acquire cryptoassets in a 100% legal way. A single registration in an EU member state will allow you to obtain a license to operate throughout Europe.

Security of Cryptocurrency Platforms: Evaluation

Binance: the cheapest

Binance, as the world’s largest cryptocurrency exchange, offers very low costs. Overall, it is the most competitive on the market, making the platform an attractive option for many investors.

Kraken, which is smaller than Binance, offers a similar experience, although it is a bit more expensive.

For those with Revolut Premium or Metal accounts, this option offers an excellent balance between security and price. However, it is not recommended to sign up for these accounts solely to invest in cryptocurrencies, unless you intend to regularly transact large amounts. For example, the savings made with a Premium account, which has a monthly fee of €8, pays off only for those who transact more than €1,600 in cryptocurrencies per month. Therefore, in our evaluation, the “standard” Revolut account was considered, the account that best corresponds to the described scenario, the €500 basket.

As for Coinbase, it is a reliable platform, but its costs are very high compared to other similar options. Although it has a different reputation and scrutiny, especially because it is listed on an exchange, it is still a cryptocurrency exchange, similar to Kraken and Binance.

Finally, Mercado Bitcoin has a huge spread of up to 3% on Bitcoin and Ether purchases. This is the worst option in terms of cost.

Commissions: How much do they charge?

In short, after analyzing all the criteria, Revolut gets the best result.

While choosing a good platform plays a vital role in mitigating the risks associated with cryptocurrencies, there are other factors that make this investment highly speculative and risky. As such, we do not recommend it. But, if you want to take a risk, focus on cryptocurrencies with higher market caps and do not invest more than 5% of your portfolio.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”