In annual terms, CFP expects Economic activity will slow to 1.6 percent in 2024Growth is expected to reach 1.9 percent in 2025 and 2.1 percent in 2026.

The Economic Prospects and Budget Report 2024-2028 indicates that budget surpluses will continue until 2028, although they will be smaller than what was witnessed in 2023.

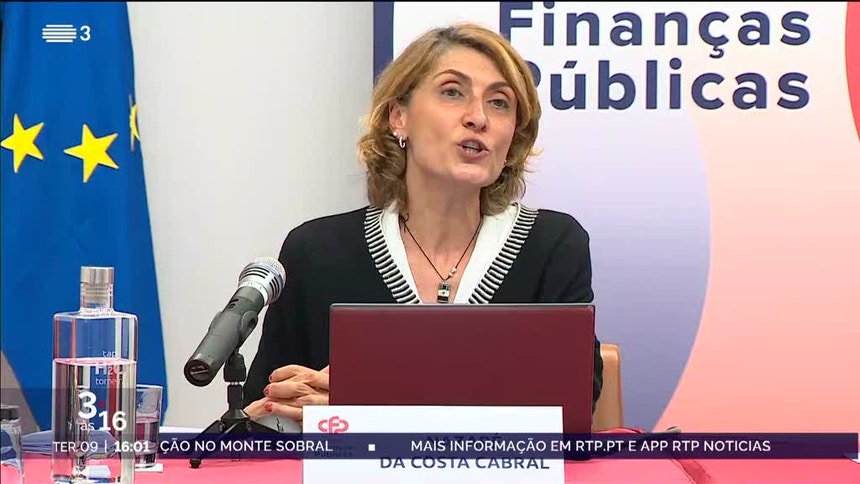

The forecast of the CFP, led by Nazaré da Costa Cabral, is practically consistent with the 1.5% recorded by the previous executive in the 2024 state budget (OE2024).

but, The establishment is more pessimistic than the governmentin the macroeconomic scenario of the program of the Democratic Alliance (an alliance between PSD, CDS-PP and PPM) for the legislative elections on March 10, in which Prime Minister Luis Montenegro was elected.

AD used a CFP growth forecast of 1.6% for this year, but for the following years it expects a rate of 2.5% in 2025, 2.7% in 2026, 3% in 2027, and 2.4% in 2028.

The CFP also projects an unemployment rate of 6.5% this year (6.4% in 2023), 6.3% in 2025, and 6.2% in 2026.

It is linked to the slowdown expected by the CFP for this year “High levels of uncertainty” regarding the war in Ukraine and the Gaza Strip“The effective transmission of the negative impact of maintaining interest rates at high levels on the Portuguese economy and the economies of its main partners.”

Meanwhile, the CFP is a little more optimistic about the rate of decline in inflation for this year, pointing to a rate (as measured by the Harmonized Consumer Price Index) of 2.6%, lower than the 2.8% expected in September, followed by 2.2%. % in 2025 and 2% from 2026 onwards.

The CFP recommends caution

These expectations do not take into account the political measures that the new government will adopt. The head of the Public Finance Council, Nazaré Costa Cabral, warned Budgetary risks if the executive authority responds to the demands of various sectors of public administration.

Nazaré da Costa Cabral highlighted that whenever there is an increase in overall spending or increases in the social area, it is necessary to adjust the budget.

The head of the CFP considered this There may eventually be a gradual phase.Because “politicians, everyone, not just the government, have to take responsibility in understanding that we will have to make a very firm commitment in terms of reducing public debt (with the European Commission).”

The new European rules will give special weight to the link between public debt and countries' net primary (non-interest) spending.

“There has to be a dose here, a titration, so that this goal of maintaining initial balances is ensured and sustained,” he warned.

The Public Finance Council also warned against this The risk of failure to agree between the parties to approve legislation related to the milestones and objectives stipulated in the permanent performance reportWhich may jeopardize the disbursement of some funds.

In the report, the institution indicated that among the internal risks threatening expectations, after the new formation of Parliament, is “the possibility of a lack of agreement between the various parliamentary blocs regarding the approval of legislation that indicates the specific milestones and goals” in the recovery process. Plan and Resilience (PRR).

The Council on Public Finance (CFP) sees this “Failure to approve this legislation could jeopardize the disbursement of some funds programmed under the poverty reduction strategy.”penalizing the investment, as well as the expected path of the real product.

With Lusa

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”